This article was original published on Czapp our data analysis portal on which our analysts share industry news daily.

The dry weather in Centre-South Brazil suggests a crop failure, which is categorised as having less than 535 million metric tonnes (mmt) of processed sugarcane. It is likely that more sugar will be made than ethanol, and less ethanol means less CBIO emissions. Will we have a CBIO supply shortage this year?

Renovabio in numbers

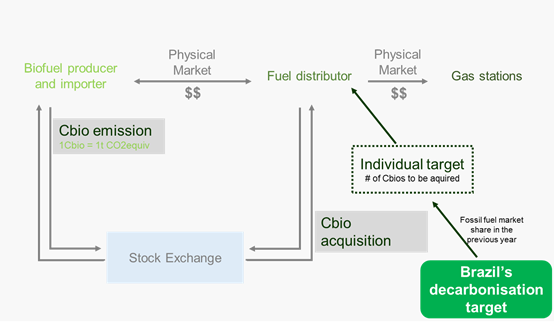

Renovabio is the Brazilian national biofuels program launched in 2016 to establish annual national decarbonisation targets for the fuel sector. These national targets are divided into mandatory individual targets for fuel distributors. To meet their goal, fuel distributors will need to acquire CBIO certificates on the stock exchange. Each CBIO emitted by biofuel producers corresponds to one ton of carbon that is not released into the atmosphere. Biofuel producers voluntarily issue CBIOs, based on their energy-environmental efficiency rating of the volume of biofuels sold.

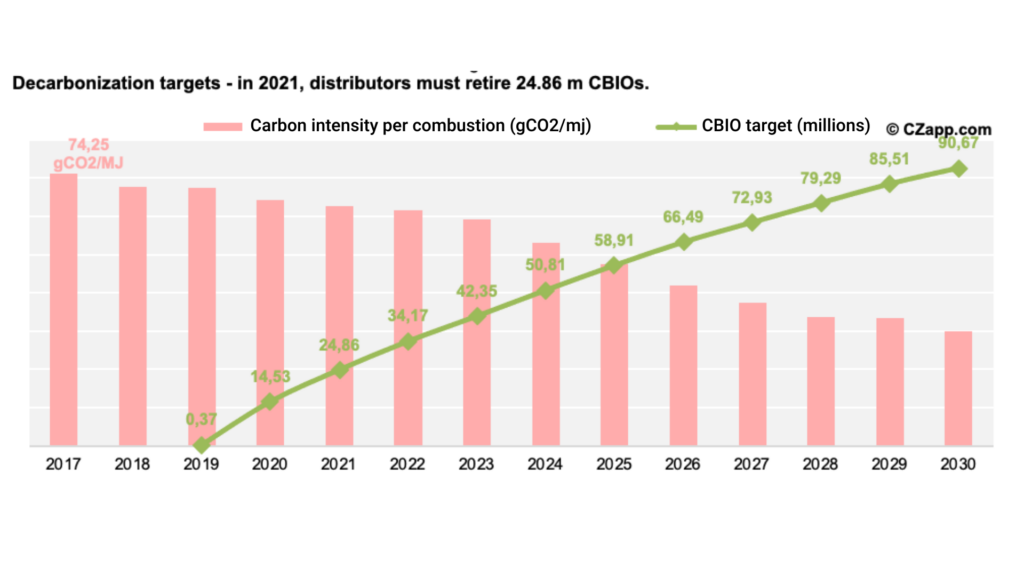

In 2020, Brazil’s Renovabio programme avoided the emission of 15 million metric tonnes of CO2. Despite the troubled start, the first year of the policy was a success with almost 98% of the decarbonization targets fulfilled: 106 distributors out of a total of 141 met the goal. For this, 14.9 million CBIOs were traded, generating a financial volume exceeding 650 million BRL.

| CBIO | |

| Issued | 18,508,636 m |

| Traded | 14,896,273 m |

| Retired | 14,535,334 m |

| Average price (BRL/CBIO) | 43.66 |

The goal for 2021 requires that 24.86m CBIOs are acquired by 136 distributors; BR Distribuidora continues with the largest share of 26.35%.

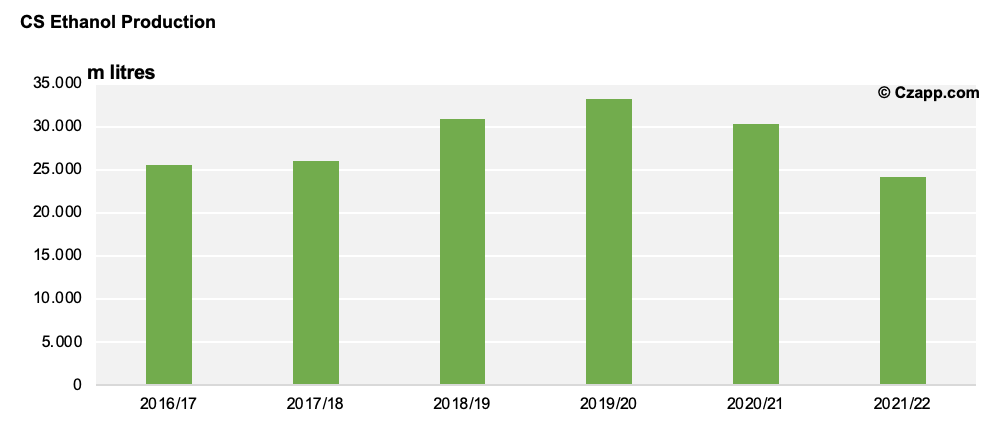

Priority for sugar, harmed ethanol

It is estimated that CS Brazil will process 535 mmt of cane this season. Since mills are advanced in sugar pricing, which it is difficult to change the mix to ethanol and market conditions are necessary to allow positive washout operations. Consequently, a smaller volume of ethanol will be produced, 24.2 billion litres to be exact. Due to the structure of the RenovaBio program, less ethanol production means less CBIOs will be emitted by the mills. So the question is: will the crop failure impact the CBIO market?

Trading CBIOs

Until 23 June 2021, a total of 13.97m CBIOs were issued by biofuel producers this year. This in addition to the 2020 surplus of 3.97m CBIOs put the available CBIOs at 17.93m meaning it is capable of covering 72% of the target. Distributors have already purchased more than 8m CBIOs, with approximately 16m remaining to be purchased by the end of 2021.

| CBIO balance | 2019/20 | 2021 |

| CBIOs issued | 18.51 | 29.81 |

| Total availability | 18.51 | 33.77 |

| Demand | 14.54 | 24.86 |

| Balance | 3.96 | 8.91 |

| Availability/demand ratio | 1.27 | 1.36 |

It is important to remember that the CBIO volume per distributor is based on their fuel sales in the previous year. Therefore, the current behaviour of the Otto cycle does not impact the 2021 targets.

If we take into account that it means that 80% of ethanol mills are already able to emit CBIOs, and the average CBIO emission ratio is 836 litres for anhydrous and 886 litres for hydrous ethanol; this year’s total CBIO offer would be 29 million. When added to the 2020 surplus, the CBIO balance will be 8m higher than the target required for 2021.

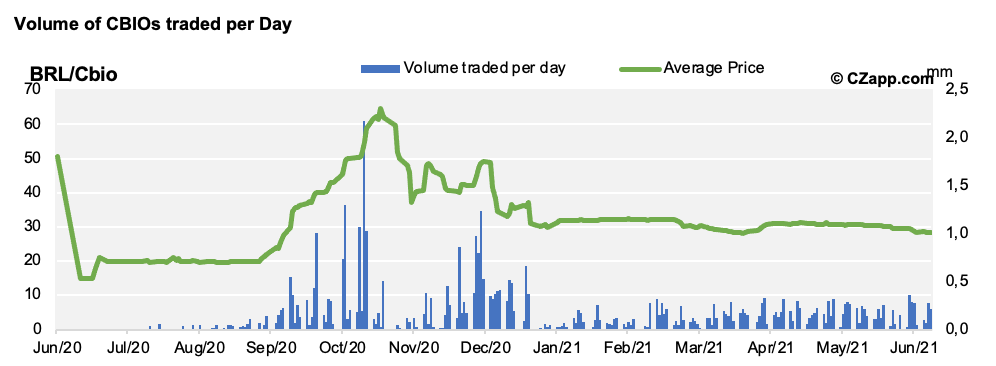

Since April 2021, an average of 176,000 CBios are traded per day, far from the liquidity seen at the end of last year. As a result, the price remains stable at around 30 BRL/CBIO and should remain so depending on the obligated parties’ buying curve.