Two commodities are in direct competition over Brazil’s sugar cane: sugar and ethanol. Milling groups therefore have a decision to make. Which commodity will offer the best return?

The truth is, it depends. And that’s why the price relationship between ethanol and sugar keeps the Brazilian sugar market guessing. There are many factors that impact which commodity is favourable at any particular time, and we will give you an overview below. If there’s just one thing you take away from this article, remember that the sugar and ethanol markets in Brazil are interdependent and therefore must be looked at together.

CS Brazil: the sugarcane capital

Centre-South is the key region to look when discussing Brazil’s sugar and ethanol producing capabilities as it processes 90% of Brazil’s sugar cane. Of the region’s many mills, 75% have the capacity to make simultaneously sugar and ethanol. The question that is forefront of any mill’s strategy for the season is which percentage of each should be made, or which one should be ‘favoured’. Typically, mills will look to the price of sugar and the price of ethanol in order to make up their minds on which commodity to favour and therefore which ratio of each to produce.

The sugar mix

This ratio of sugar to ethanol is also known as the ‘sugar mix’. Each mill has its flexibility, or how much can allocate to sugar or ethanol, ranging from 50/50 to around 80% sugar and 20% ethanol. But the average sugar mix in CS ranges between 34-48%, meaning that a swing from min to max can reduce or add 10 million metric tonnes to the world sugar market. This is a volume large enough to impact global sugar stock trends. So, a favouring of ethanol on a particular crop and a decrease in the sugar mix will drive global sugar supply and therefore impact sugar price in Brazil and elsewhere.

Are you still with us? It gets a little easier in the next paragraph.

Sugar and Ethanol parity

So, how do mills decide ahead of time which commodity, sugar or ethanol, will provide the best renumeration? They refer to something called ‘sugar and ethanol parity’. Simply put, this means the point at which sugar and ethanol prices are equal, and therefore deliver the same return to the mill.

The ethanol parity is in direct correlation to the sugar market and can also be thought of as the point at which sugar prices can fall before ethanol starts to become more attractive. Keeping the point of ethanol parity in mind is important for milling groups wanting to make decisions on what to produce moving forward.

[banner text=”Interested in energy products?” button=”Find out more” link=“/products/energy”]How does oil price fit in?

We need to step in and quickly mention oil at this point.

The price of ethanol in Brazil is related to the price of domestic gasoline because 80% of its fleet is composed of FFV (Flex Fuel Vehicles). These vehicles can run on gasoline and/or hydrous ethanol on any proportion. This means that consumers demand is driven by the competition between these fuels. Given the lower energy efficiency of ethanol when compared to gasoline, ethanol prices need to be 70% or lower than of gasoline to incentivize demand for the biofuel.

If crude oil prices are high, gasoline will also be high and ethanol prices can go up without affecting its competitiveness. This means that it remains popular at the pumps, increasing the demand and possibly returns for millers.

Price trends and influences

Many factors can drive the price of sugar and the price of ethanol.

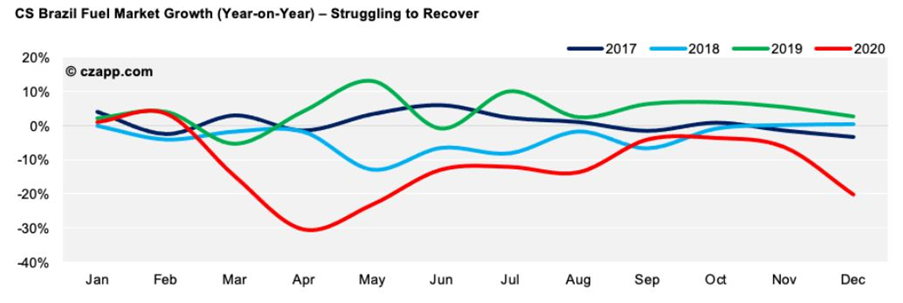

At the early stages of the pandemic, ethanol prices fell significantly as less people were using their cars. Weather conditions also can impact sugar prices if they mean that less sugarcane is available for crushing, tightening supply, and raising prices. The stage of the season has an influence over mill’s decision making too, as at the start of the crop cane has a lower sucrose content meaning is most suited to ethanol production. In short, there are many additional factors outside of global commodities markets that can also impact price. This means analysts are always watching for outside elements which can also drive price.

Hedging vs spot price

Another element to consider when deciding whether to produce sugar or ethanol is the different methods available in terms of pricing each commodity. Sugar can be hedged on the futures market, meaning that sugar mills can set a fixed, favourable price for crops in the future and reap the rewards. Ethanol on the other hand is largely priced on a spot basis, meaning it’s sold based on the present price. Since it is not hedged the same way as sugar, any future price changes are a risk you’d need to be willing to take if you’re making ethanol.

This plays into decision making because each has a different risk outlook. If sugar prices are high and solid, a mill might prefer to hedge a large amount of sugar using futures. However, ethanol spot price can be useful if it sees a sudden rise in price or popularity, for example when crude oil prices rise.

[banner text=”Looking to manage price risk?” button=”Find out more” link=”/services/price-risk-management”]Putting this into context

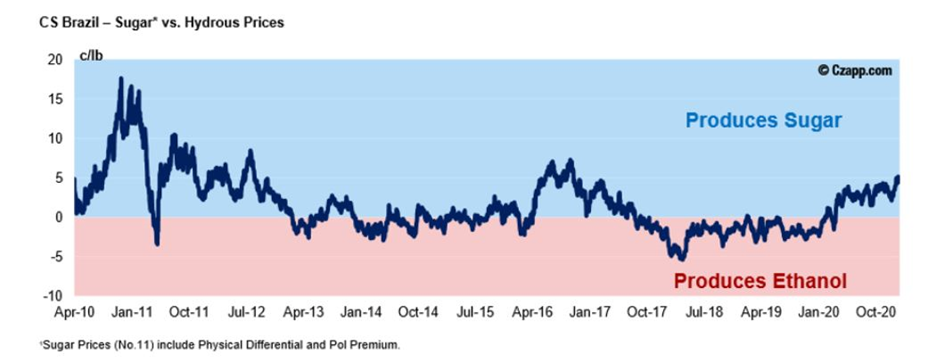

If we look at the current situation with sugar vs ethanol in Brazil, we can begin to put some of these concepts into practice.

Let’s take the current situation:

Covid-19 has adversely impacted oil prices, domestic gasoline prices in Brazil and ethanol prices. This is because demand significantly dropped as a result of the pandemic.

Meanwhile, raw sugar returns are at record returns in terms of the Brazilian real. This means that mills can take advantage of the current high sugar price and hedge on the futures market.

Both factors in combination have driven mills to favour sugar production and hedge a large proportion of their sugar well into 2022/23. The mills are in an advantageous position if ethanol prices unexpectedly rally enough to allow the unwind of their sugar hedge and sell ethanol on a spot basis instead.

As Covid-19 continues across the world and badly affects Brazil in particular, it seems likely that the fuel market will take some time to recover and sugar will be preferable for the time being. The current raw sugar price outlook points to sugar holding an advantage over ethanol throughout the season.

This is where we have been in recent months:

You can see the sugar is increasing in price, and therefore in popularity with mills.

The sugar vs ethanol question is ongoing. On Czapp, our analysts give weekly updates on the sugar mix and sugar and ethanol price comparisons. In addition, they write longer reports and provide advisory services. If you’d like this information, all you need to do is sign up to Czapp for free today.

Author: Carys Wright