Recycling is more complex than it immediately seems. Although often touted as a positive solution, there are many factors that make recycling unviable, complex or underused. We will explore the main challenges, processes and solutions in this blog. Bear with us for some in-depth exploration.

Contents:

- Where is plastic recycled?

- Types of plastic

- What is rPET?

- What happens to my plastic bottle?

- The chemical processes for plastic bottle recycling

- Recycled PET and pollution and the circular economy

- The challenges

- Alternative solutions

- Our approach

Where is plastic recycled?

Only 9% of the world’s virgin plastics are recycled, and the reason for that may seem absurd – finding efficient ways of collecting viable plastics for recycling is hard [Czapp]. Before plastics can be made into flakes and pellets they need to be collected and transported to the facilities that transform them. And that’s where the first challenge in making recycled plastic available presents itself: how to gather all the plastic.

In 2020, the COVID-19 pandemic slowed down collection, plus growth in US recycling rates has plateaued over the last five-to-six-year period, dipping to just 27.9% in 2019. Back in 2018, Europe collected twice the number of post-consumer plastic than it did in the previous year – but just under a third of it was recycled.

The US Environmental Agency reported that from 1990 – 2015, plastic was the least recycled material in the US (the most recycled was paper). This outcome is largely due to chemical plastic recycling methods like depolymerisation, pyrolysis and solvolysis not being scaled up for large operations.With more pressure to act on the impacts of plastics and single waste plastic being banned in more nations, chemists and engineers in this field will need to work with plastics producers to make large recycling operations ubiquitous.

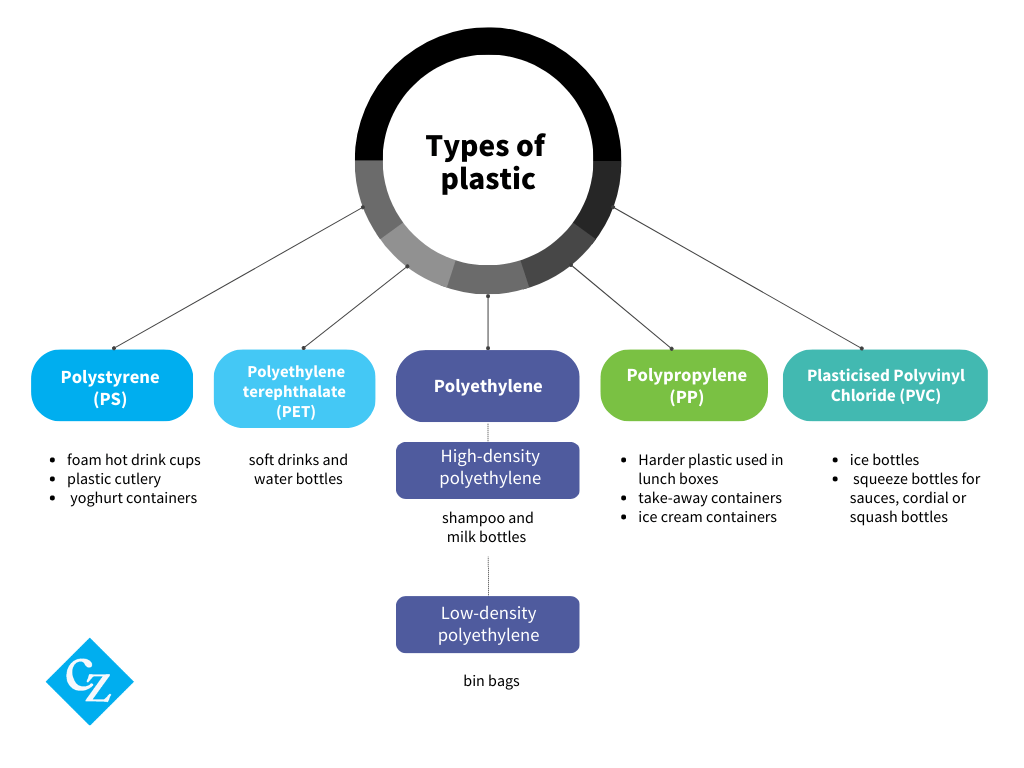

Just some of the types of plastic

Only PET, HDPE and PVC are ordinarily recycled under usual roadside collections. PS, PP and LDPE tend to get stuck in the machinery used for recycling, so are often not recycled. You can find out more about how to recycle different plastics using this great resource by Recycle Now.

Composite plastics, which are made up of a mixture of plastics, are the most problematic. Items such as toothpaste tubes, takeaway coffee and coffee capsules contain a mix of materials that are a nightmare for the recycling chain. It is very hard to separate these materials and often they overwhelm the capabilities of recycling plants.

And finally, as mentioned above, plastic loses quality each time it is recycled. This means that there will always be a need for virgin plastic if we continue to use plastic for the same purposes that we currently do.

What is rPET plastic?

Recycled PET (rPET) is sometimes called rPET resin, a resin is a mix of organic compounds that are either solid or (usually) highly viscous and are eventually cured into solids. PET is a non-toxic synthetic resin and a type of polyester used to produce food packaging and clothing. PET is the most consumed plastic in Europe and in the food ingredients and agricultural sectors overall because it works well as a fibre, film and container.

PET is the 4th most common resin in the world and its most recycled plastic.

Melting plastic into sheets

Polyethylene terephthalate is in a class of plastic polymers known as ‘thermoplastics’ which means that you can change the structure of the plastic at a specific temperature known as the ‘melting point’. For PET the magic number is 225C, meaning the plastic becomes pliable once it reaches that point. After sufficient melting, PET can be thermoformed into sheets.

PET flakes

PET is recycled using mechanical or chemical means but it also starts at a material recovery centre where the plastic is cleaned and sorted by colour and size, thankfully made more efficient by near-infrared light which detects the properties of different plastics. Mechanical, or physical recycling, can be grinding, crushing, re-granulating and compounding PET into PET flakes. In the final step, contaminants in tiny flakes are filtered out with a liquid. Mechanical recycling is the dominant method in Europe but drops in rPET feedstock can reduce its viability.

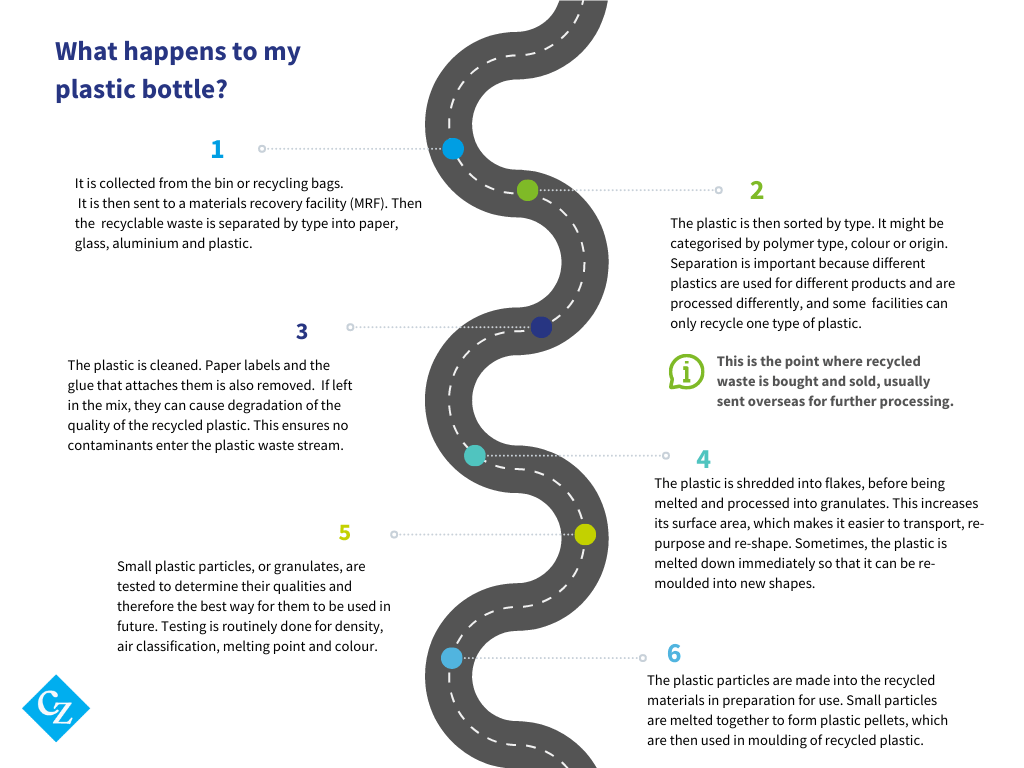

What Happens to My Plastic Bottle?

For most of us, our relationship with the products and packaging we consume ends the moment we put them in the bin. Let’s be honest, we normally just forget about it. But it doesn’t just disappear.

If we use a general waste bin, that’s it. It won’t be recycled but will end up in landfill, along with the 79% of plastic that ends up there. But what if we place our bottle into a recycling bin?

Plastic pellets are used to form a wide range of recycled materials. Not only plastic bottles but carpet, fabric and clothing, furniture, bottles, pipes and buckets. However, plastic does degrade through the recycling process and can only go through it once or twice before becoming unusable. So, our plastic bottle will not be able to become another transparent plastic bottle. Rather, it is more likely that the plastic from the original bottle will be used to make another material such as polyester for clothing or will be mixed with virgin plastic to create a partially recycled bottle.

The chemical processes for plastic bottle recycling

- Depolymerisation: Plastics are polymers, a natural or synthetic material composed of smaller units of molecules, called monomers, in a repeating chain. This means that plastic must be separated into monomers before being reconstituted into the recycled plastic that you know. Depolymerisation could be considered an umbrella term for the other methods we will discuss.

- Pyrolysis: this is essentially using heat (temperatures much higher than 225C, ranging from 500C to even 900C) to change the chemical composition, specifically to transform it into a liquid oil. When you think of changing an object’s composition with heat your mind tends to go to combustion but that is where pyrolysis is different – it decomposes plastic in the absence of oxygen. Since objects only burn when oxygen is supplied, there is no combustion in pyrolysis. It is because pyrolysis is endothermic (a chemical reaction that takes in heat instead of expelling it) that makes pyrolysis is an attractive option: it is the most environmentally friendly method for recycling plastic because it produces low volumes of combustion gases, and the oil produced could provide valuable energy for transportation. This means pyrolysis can fall into the ‘energy recovery’ category not just recycling.

- Solvent based: You may also hear it called ‘solvolysis’, except this is also an overarching term for glycolysis, hydrolysis, alcoholysis, and more. ‘Lysis’ means ‘to break down’ so solvolysis is the process of breaking down a substance using a solvent; for alcoholysis the solvent is alcohol. Solvolysis is less used than mechanical recycling because the solvents needed are costly and contamination issues sometimes arise.

- Polyethylene terephthalate is the easiest plastic to recycle and frequently used in the

Recycled PET and pollution and the circular economy

Reusing materials is one of the core practices of a circular economy, that is an economy designed to tackle international issues, namely global warming. As more international organisations are challenged to reduce their carbon emissions, more investors are making a stake in recycled PET. In mid-2021, several major virgin plastic producers invested in RPET production facilities in the US and Australia. The European Union’s bid to reduce 55% of plastic waste by 2030 means recycling operations need to improve substantially. Still the unequal distribution of the technology for recycling across EU nations, compounded with struggles to provide high quality, cost efficient, non-contaminated recycled plastics is an ongoing challenge for the industry, but one that is being tackled by more stakeholders nonetheless.

So what are the challenges?

The main challenges with large scale recycling include falling recycling rates, limited capacities/ facilities and limited technology.

Falling recycling rates

Recycling rates have stagnated. For example, in London some councils have debated giving up on recycling altogether as incineration (while being criticised for its energy use and emissions) is seen as less polluting and complex than landfill and recycling. In 2017/18 Westminster council sent 82% of all household waste, including recycling, for incineration.

These slowing rates are caused by a range of factors, from funding to policy to consumer behaviour. It can be hard to clearly measure rates of recycling, as it is hard to follow specific waste down an entire waste stream. We do know though that our current recycling systems only capture about one fifth of the recyclable material we use. It’s clear that we need to get some answers on how to improve our recycling capabilities.

Plastic in transit

Aside from the fact that collecting plastic is not easy and not all plastic can be recycled, it’s also worth noting that the process described above does not necessarily take place at one processing facility because stakeholders want to access the most efficient processing facilities and capacity.

However, there are also downsides to this trade in waste, including the requirement for transportation adding to the carbon footprint of the process. Until China closed its doors to our Western waste, our plastic was routinely being shipped there. This reliance on exporting plastic waste has meant that infrastructure in the UK and other exporting countries is not sufficient to process the amount of waste that is generated locally. Unfortunately, the problem does not end there. While China does not now accept waste, the burden has been passed onto other nations such as Malaysia, India and Thailand.

We know that waste is often moved from country to country, but a lack of transparency and traceability begs the question of who is responsible for waste – the producer, governments, the consuming country, the recycling country, or the individual consumer?

Let’s look into plastic that does get recycled.

What alternatives are there?

Activism and Change

Leading packaging NGO Wrap created The Plastics Pact, signed by many leading brands, which sets ambitious targets for an increase in recycling and reduction of single use plastic items by 2025, a mere 5 years away. This week, the UK banned 3 out of 10 target products mentioned in the pact: plastic straws, stirrers and cotton buds. This shows that aggressive lobbying can work, and will hopefully set a precedent for more items and geographies to be adopted under similar schemes.

Science and Innovation

We mentioned chemical recycling in our latest blog, but a sign of the speed of current innovation to solve the plastics crisis is that since then even more impressive science has emerged.

A new super-enzyme that eats plastic bottles six times faster than previously has emerged which could be ready for use in a year or two and also has the added benefit that it can work at room temperature. Scientists at the University of Portsmouth have adapted natural enzymes first found in Japan in 2016 by combining them with an engineered version that appeared in 2018. Their potential has caused widespread hope that nature and modern science can together provide a solution to our mounting plastic problem.

Bioplastics have also emerged as a potential alternative to virgin plastics. These use organic alternatives rather than petroleum, often using sugarcane and corn to convert sugar into polylactic acids (PLAs). Because this can be done as a by-product of sugar or ethanol production, this type of plastic is cheaper and more common than alternatives using microorganisms. The major argument to support the use of bioplastics is that only the amount of carbon associated with the organic material will be released back into the atmosphere, rather than carbon originally trapped safely underground in the form of oil, which once released adds to the overall carbon footprint of the planet.

However, bioplastic isn’t immune to its own challenges. Using food items like corn or sugarcane for plastic is contentious in an already food-scarce world. These crops also take up land and water. The largest challenge however is that bioplastics need specific conditions in order to degrade successfully. Industrial composting is necessary to bring the bioplastic up to a heat high enough to allow it to break down within a meaningful timeframe. This means that if bioplastic ends up in landfill along with most petroleum-based plastic, it will still last for decades and cause pollution in our oceans. To combat this challenge, the UK has recently implemented new standards for bioplastics, seeking to eliminate a wide umbrella term that might be used by materials that still contain microplastics. But essentially, until we get better at getting rid of bioplastic properly, it is still a potentially polluting product.

Everyday Materials

The fashion industry has embraced recycled materials at an increasing pace, with brands such as Allbirds trainers leading the way. Their shoes are made from recycled materials – a range of wool, wood, sugar and eucalyptus fibres. Each pair comes with a label detailing its carbon footprint, in a drive for transparency and accountability.

Construction currently accounts for the majority of problematic waste globally. Industry-leading Danish textile company Kvadrat has started to take advantage of the fact that 95% of textiles are recyclable but only 25% are recycled. As part of their ‘Really’ project, their fabric is being made into recycled materials that can be used to challenge the design and architecture industry to re-think how to embrace a circular economy.

Recycled PET fabric

If you own a T-shirt, tote bag or any other clothing made from former plastic bottles, you most likely have a piece of what is now considered the future of sustainable textiles. Producing recycled PET is half as carbon intensive as producing organic cotton. RPET fabric is the result of melting PET bottles and spinning it into polyester fibre or ‘yarn’.

Our Approach

At CZ, we feel responsible for the fact that we work with organisations for whom plastic is a central part of their business. This is why, when moving into new packaging areas such as PET, we must ensure that we inform ourselves about the potential dangers and work to increase the capacity for recycling in our supply chains. Indeed, many of our clients have made bold commitments to increasing recycling of plastics and we stand ready to support them in these goals.

We recognise that packaging pollution is a global problem that we cannot overcome alone, and hope to work together with plastic producers and consumers, global and national corporations, NGOs and policy-makers to find solutions to our plastic crisis that are beneficial to all.