- This is a transcript of a sugar market report speech given on 23/05/19 in Bangkok.

- It gives a sugar industry outlook for 2019 and 2020, with a special emphasis on the Thai sugar market.

- If you are interested in being invited to future seminars hosted by Czarnikow, please email support@czapp.com with “Invite Me” in the subject line.

Have we mentioned before there is a lot of sugar in the world?

Everyone agrees we have an oversupply of sugar in the market.

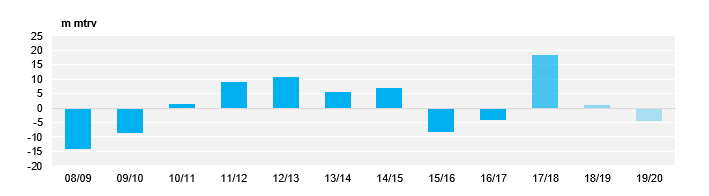

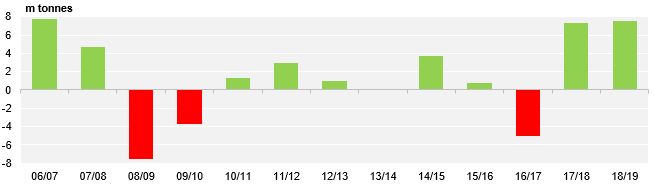

Global Change in Sugar Stock

Wilmar gave a presentation in Australia last week using this exact same chart. When everyone thinks in the same way it makes me worried – it usually means we’re all due a surprise. But today the facts are clear: around the world we produced too much sugar in 2017 and 2018.

The chart above shows the amount of sugar produced each year with the amount of sugar consumed subtracted. It therefore shows the global change in sugar stock each year. You can see the two large drawdown years in 2009 and 2010 which saw sugar prices climb towards 36c/lb and then the huge stock build which has seen prices fall all the way back to 10c.

In 2019 we’ve made less sugar than the year before, but we have still overproduced. We therefore have more sugar on the planet today than we’ve ever had before. This is priced into the sugar market already, but we need to be aware of two risks which might change how we think about price.

The first is that we need to watch out for anything which might lead to a drawdown in stocks. High sugar stocks are the safety net around the market; while they exist it’s hard for the price to strengthen rapidly because buyers don’t need to chase the market higher. We need to watch for things which lead to stocks being consumed because once the safety net disappears prices will reflect increased risk in the market. In other words, prices will strengthen.

The other risk is that everyone wants to look smart. Everyone wants to be the first to see the moment prices turn upwards. But the market can continue to be oversupplied and prices can keep trading lower. I think it’s this second scenario that’s more likely in 2019. We are all trying to spot signs of life in the sugar market, but I wouldn’t be surprised if we re-visited the 10c low in the next 6 months.

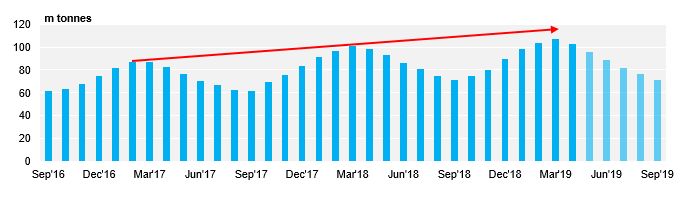

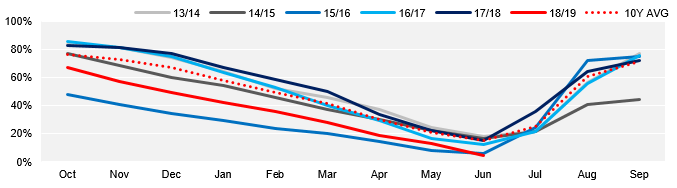

Global Sugar Stocks by Month

This chart shows our estimate of global sugar stocks. It’s built from our SQL database of the sugar situation in every single country in the world. In our new platform Czapp we show this data in the Stocks-To-Use chart (https://www.czapp.com/sugar-data).

The stock-to-use shows sugar stocks divided by annual consumption. As a rule, a normal stock-to-use ratio is 13%-20%. This level of supply is needed to ensure logistics are not stretched. Below 10% stock-to-use and you run the risk of stock-outs. Above 20% everything is comfortable, but carrying the stocks is expensive. You can use the Sugar Data area in Czapp to see for yourself that most regions in the world, except for Europe, have stock-to-use ratios well in excess of 20%.

When white sugar is held as stock with end-users as far as the futures market is concerned, it doesn’t really exist. This is because the No.11 raw sugar and No.5 white sugar markets are both FOB contracts. Once the sugar has crossed the ship’s rail at the loading port, as far as the futures are concerned it’s been consumed.

So these high stocks are not necessarily a major problem for the sugar futures price. The market doesn’t care if India has a lot of sugar in stock if it cannot be exported without a subsidy. It doesn’t care about stocks of white sugar far inland in Myanmar awaiting transit to China. Rather than looking at stocks, let’s instead look at what sugar is available to the futures market and worry about this instead.

Quite a lot of this sugar is still to be sold

To do this, we use Trade Flows. What on earth is a Trade Flow?

For every country in the world we work out exactly how much sugar we think is produced and consumed, and how much it holds in stock. We then work out what each country can sell or needs to buy for each month, and at what price it will do this. When we aggregate this information, it helps us to see where potential supply and demand mismatches are, and what the price needs to do to resolve these mismatches.

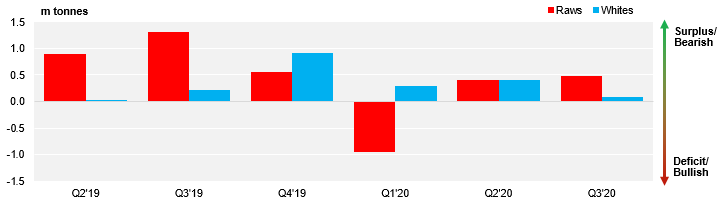

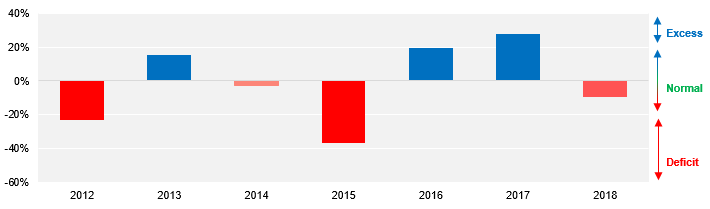

Global Sugar Trade Flows

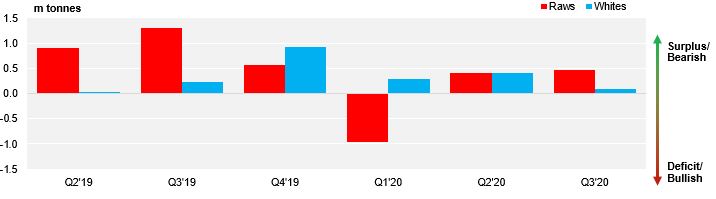

We plot this information as a chart, with oversupplied quarters above the zero line and deficit quarters below the zero line. While we show the quarters as discrete entities, sugar that is in surplus today is carried into tomorrow, so the effects of Trade Flows are cumulative. Likewise, raw sugar and white sugar are linked; the main function of raw sugar is to be processed into whites.

Looking at this chart today, we can see that the raw sugar market is heavily oversupplied at today’s prices. The white sugar market is also oversupplied, but to a lesser extent. This oversupply will accumulate and persist into 2020. This is why I remain negative on sugar price.

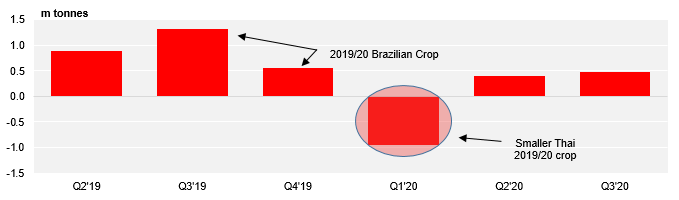

Raw Sugar Trade Flows

Looking at the raws in more detail, we calculate that there is 3m tonnes surplus raw sugar across the next 12 months. This raw sugar is located in Thailand, a result of this year’s large crop. We think there could be 1.3m tonnes excess raw sugar in Thailand this year.

Most of the rest is about to be made in Centre-South Brazil. The crop there has just begun, is starting slowly and mills are making ethanol, not sugar. This year the Brazilian milling industry sees itself as a fuel producer, not a food producer. This is because ethanol prices are around 13c for the mills versus sugar at close to 12c.

We think CS Brazilian mills will produce 26.5m tonnes of sugar this season, of which around 17.5m tonnes will be raw sugar for export. This is actually a greater allocation to sugar than we saw last year. Some of the mills we have spoken with in Brazil told us that last year they pushed their cane juice allocation too far towards ethanol and they damaged their operational efficiency as a result. This year they don’t want to repeat the same mistake and so won’t make as much ethanol.

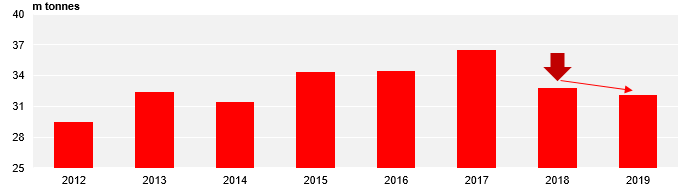

CS Brazilian Raw Sugar Availability by Season

Brazilian raw sugar is the feedstock for many of the refineries in Africa and the Middle East. However at today’s prices we don’t expect to see a lot of raw sugar demand this year from those refiners. The white premium is too low for them to operate profitably at full throughput. The refinery in Dubai, for example, has spent more time offline than operational this year. We therefore think that global raw sugar demand will be the lowest in 5 years in 2019, unless raw sugar prices and spreads continue to weaken.

Global Annual Raw Sugar Demand

What does this mean for Thai raw sugar?

At today’s prices we don’t think there will be enough demand from Indonesia, Malaysia or other regional buyers to soak up all the Thai raw sugar that’s been made.

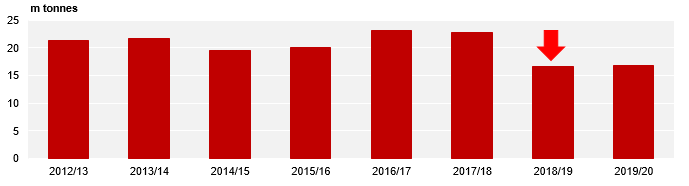

Thai Raw Sugar Availability by Season

It’s been an amazing year for Thai raw sugar production. 11m tonnes of raw sugar were made during the cane crushing campaign, and 3.5m tonnes could be remelted into refined sugar to give 7.2m tonnes of raw sugar for export in 2019, which is a record. What happens to the excess?

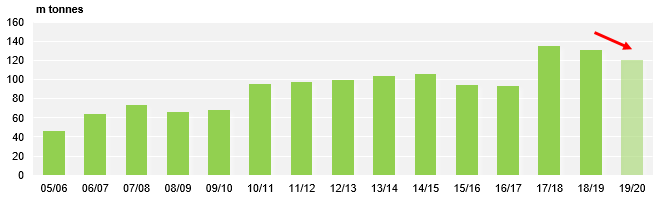

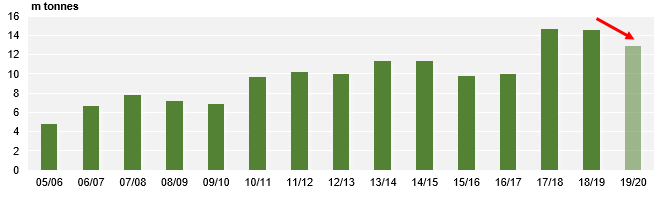

Thai Cane Production by Season

We think that it will be carried into 2020, and so will still be in storage when the next sugar cane harvest begins in November 2019. This may not matter a great deal if the next harvest starts later than we expect, and it might because we think there will be less cane to crush next year, perhaps only 120m tonnes. We think cane area has decreased in the North and North East of the country as farmers have planted acreage to cassava. We forecast sugar production next year will only reach 12.9m tonnes, down from 14.6m tonnes this season. If next year’s sugar production is 1.7m tonnes lower than this year’s, there could be room to carry 1.3m tonnes of raw sugar.

Thai sugar production by Season

There is certainly enough warehousing capacity to do this. However, a carry of this scale will bring other challenges at the start of 2020. Warehouses won’t be totally empty at the start of the next harvest, which could lead to logistical delays earlier than usual in the season. Old crop and new crop sugars will need to be segregated. Carrying sugar may lead to cash flow difficulty for mills. In addition, this carried sugar will need to be sold at some point in 2020. Will there really be enough demand for old crop Thai raw sugar in Q1’2020? Will it need to be blended with new crop raw sugar to be acceptable to buyers?

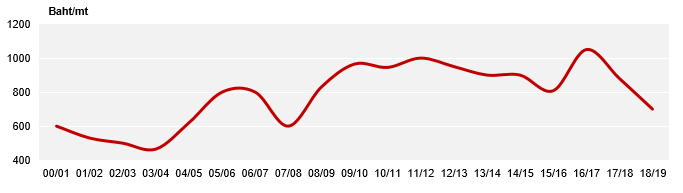

Thai Cane Price

A final point to add is that this level of oversupply from the world’s two largest raw sugar origins is not good news for price. If we are to stop the downtrend in the sugar market, we need to remove the stock safety net in the market. Based on this analysis, this is more likely to happen in the whites and not the raws, so let’s look at the whites market in a bit more detail.

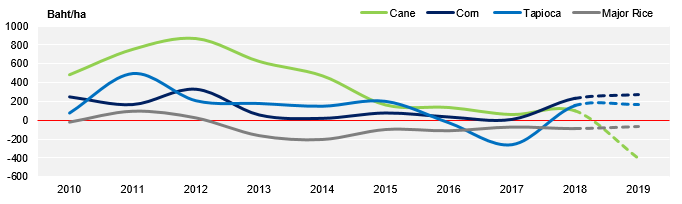

Thai Farmer Returns

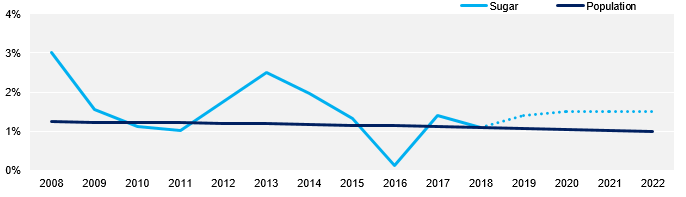

Why isn’t sugar consumption growing like it used to?

Sugar consumption has been a bit of a problem in recent years. Consumption growth is driven by increases in population and wealth. Everyone on the planet eats sugar and as people become wealthier their diet changes to include more processed foods, which tend to contain more sugar than traditional foods. Besides, people want to spend money on things which are enjoyable and sugar tastes good.

In the past we assumed that 2% annual sugar consumption growth was normal; 1% for population and 1% for increasing wealth. But it’s been a long time since we hit 2% global consumption growth. I think 1.5% per year is now the new normal. One problem is that many wealthy countries are now seeing per capita decreases in sugar consumption.

Global Sugar Consumption Growth vs Population Growth

This is partly due to increased consumer awareness of how much sugar they consume. Most people in Europe would tell you they are trying to reduce their sugar consumption, for example, though what people say and what people do are two different things. Consider that people would tell you they don’t want to spy on their friends yet Mark Zuckerberg is one of the richest people on the planet.

We are also increasingly seeing the impact of regulation on the sugar market. Sugar taxes have become more widespread in recent years, but they have a mixed track record. For example, in Mexico and Denmark they were ineffective. In Mexico the cost of the tax was passed through to consumers, and after an initial decrease in sales life continued as normal. People got used to higher prices and it didn’t affect their consumption. In Denmark, people shopped in Sweden or Germany instead where possible.

However, the example in the UK was different. Two years ago the government introduced a tax on sugary soft drinks. Many companies chose to reformulate so that their sugary drinks weren’t at a disadvantage to their competitors’ diet drinks. Another trend in the UK is that many food manufacturers are now voluntarily reducing the serving size of their products in the face of government pressure. This means we’ve seen sugar consumption rates being trimmed, especially among the Anglosphere.

Elsewhere, similar trends are occurring. In China, there’s been almost no sugar consumption growth in the last three years. Domestic sugar prices there are high (above $700/mt) as a result of government policy to protect the local sugar industry, and so drinks manufacturers have used cheaper corn-based sweeteners instead. Brazilian consumption growth was hit by 2016’s recession and is yet to fully recover.

This weak consumption growth is making it hard to draw down global sugar stocks by as much as we would like. So if we are to resolve the white sugar surplus we need to turn to the major white sugar producers and see how they interact with the price. I think whites origins are best divided into two according to how they interact with the futures market. There are those who hedge production in the refined sugar market – flat price sellers. This includes India and Europe. Then there are those who hedge the white premium. This group includes re-export refiners and also Thai sugar mills when they remelt raws into whites.

Flat price sellers in the white sugar market

Let’s start with those producers who hedge the No.5 market outright. This includes Central American and CS Brazilian mills that make refined sugar for export. It also includes in-harvest Thai refined production for export. In each case, this production is relatively dependable each year.

For this presentation, I’m more interested in the variable suppliers of whites, who can swing their supply according to what the market is doing. They are the marginal suppliers who have a large impact on the state of the market. The prime flat price sellers who fit this category are India and Europe. Let’s look at India first.

Everyone knows Indian production swings according to a cycle. Everyone is wrong.

Indian Net Sugar Production

India hasn’t followed a classic swing cycle for a decade. India nowadays is more likely to overproduce sugar than underproduce. India has made too much sugar in 9 of the last 13 years. It’s only been in deficit 3 times since 2008. The problem is that the government has set cane prices at such a high level that no other crop comes close to giving the same returns. Even though farmers aren’t being paid in full or on time for their cane, even getting 50% payment makes cane a better returning crop than most others. This is why Indian farmers don’t change crops despite all the fuss about late cane payments.

The Indian government know this. They know they are locked into high cane acreage every year due to the cane price. But they can’t drop the cane price meaningfully because they need to preserve farmer incomes. So India will either build stocks each year, needs to export sugar or needs to find other uses for the sugar.

While India is a reliable overproducer of sugar, it’s not a reliable exporter. The high cane price for farmers also means that the cost to produce sugar is high for the mills. The government has fixed the local sugar price so mills don’t lose money, but this means the domestic market is above the world sugar market. If mills export, they make a loss. In order for mills to export, they either need the world market to strengthen or they need an export subsidy, which is what happened this year. So whether India exports is entirely a political decision.

What will happen in the coming year? There are quite a few possibilities. India will still have high stocks, which means it is likely the government continues to seek exports. A major mandate for the new government is to ensure there is no farmer unrest and farmer earnings are preserved. Reducing the cane price or linking it to the domestic price won’t achieve this. Farmers won’t reduce cane acreage significantly because returns are still so good. So really, the crop and stock outlook comes down to the weather.

Cane in South West India, the states of Maharashtra and Karnataka, are dependent on irrigation for water availability, which means that the amount of water available in reservoirs is important. The key reservoirs for irrigation are already dry. The last time this happened this early in the year we saw production in the two states combined collapse from 13.3m tonnes to 6.3m tonnes. This year we don’t think we will see such an extreme fall. However, we do need this year’s monsoon to be normal to replenish reservoirs.

Reservoir Levels – Whole Maharashtra

Average Monsoon Deviation in MH’s Key Sugarcane-Producing Regions

A poor monsoon could see India produce the same amount of sugar as it consumes. This would mean stocks would not grow year on year, potentially reducing the incentive to export. This removal of Indian supply would have an impact on the world market, by removing the safety net we currently have and could see the world sugar price increase.

If the monsoon is normal, India will add further to stock and more exports are inevitable. This is what we are currently assuming; that India will export 3m tonnes of sugar next year. This would be negative for price.

Onto Europe. Europe is likely to remain a significant refined sugar producer for years to come. North-West Europe is one of the most efficient and lowest-cost sugar producing regions anywhere in the world. In many cases farmers own the processors or have beet contracts which share world market returns. Beet is a good rotation crop; it fixes nitrogen back into the soil. It’s also an annual crop, with acreage being planted in the spring and harvested in the autumn. This means that farmers are likely to continue to allocate a significant acreage to beet in the future, and this especially applies when world market prices are above cost of production. In fact, farmers can respond rapidly to changes in price.

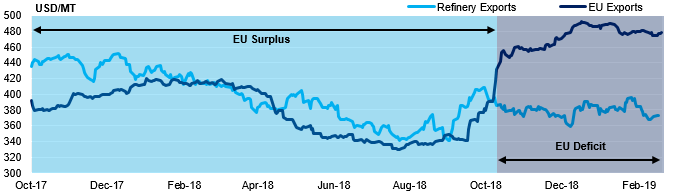

European Prices vs the World Market

If the world market price and the European price are aligned, Europe is likely to have surplus sugar for export unless weather conditions have been poor. But if the world market price is weak, such as we are seeing today, Europe may not export. Europe therefore is now a stabiliser for the whites market, and one that can move moderately quickly as prices move. The fastest movers remain the refiners, so this is where we shall turn our attention next.

White premium sellers

All the other white sugar origins we are going to look at today are white premium sellers. How they all compete depends on the cost of getting the raws feedstock to the refinery, the cost of conversion and then the cost of getting the whites to the port or to the end-customer. So, things like having efficient raws intake operations and high levels of raw sugar storage can have a very large impact on whether a refiner is profitable or not in the current climate.

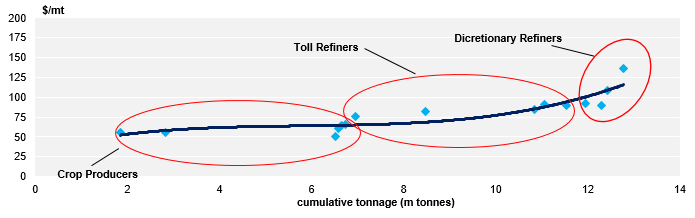

Refined Sugar Supply Curve

Here is our model, showing how much refined sugar becomes available to the market at each price, expressed as $/mt over the raw sugar market.

When we model this we can see three broad categories exist. We have refined producers from crops and the refiners who have access to domestic raws, who can sometimes survive even with a white premium below $50. We have the toll refiners, those whose business is predominantly built around re-export of whites from imported raws. These usually require around $100 over the No.11 as part of their business plans. This includes the white premium, and also the refined physical premium they charge. So we often assume that a white premium of $75 is tolerable to them. Finally, we have refiners who are less efficient and those who don’t really export on a regular basis. This is more of a discretionary refining model and they need a compelling reason to re-export refined. This means they often look for white premiums above $100.

In this model we can see where the flexibility lies. Toll refiners are key. When the whites market is oversupplied, it makes sense for the white premium to be below $75 to reduce the discretionary supply of refined. When this oversupply disappears, we need the white premium to recover to bring more refining capacity online. This can happen incredibly quickly, so toll-refiners are the most nimble swing producers in the market.

We have already seen this in the white premium this year; we’ve traded in a range between $50 and $70. I think this will continue, and this is exciting because it gives efficient refiners the chance to hedge if they can be bold when prices approach the top of the range.

White sugar demand

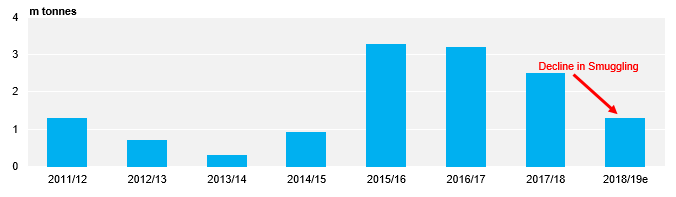

Before we look in a bit more detail at managing white premium risk let’s take a quick look at regional white sugar demand. China dominates East Asian white sugar demand. It imports whites under quota, but also in recent years has smuggled up to 3m tonnes of white sugar a year through Vietnam, Myanmar, Laos and Taiwan. This has been one of the largest movements of sugar anywhere in the world each year.

This is slowly changing. Border patrols have been increased this year because the smuggling was conflicting with Beijing’s ambitions to modernise the sugar industry. The government needed high domestic prices to ensure sector liquidity as it tried to consolidate inefficient milling groups.

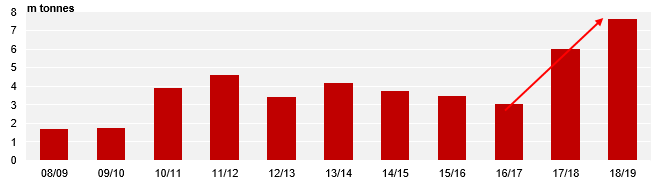

Chinese Smuggling Volumes

Away from China, regional whites demand in East Asia is not growing very quickly. Bangladesh and Malaysia meet their own whites needs through domestic refineries. Myanmar consumption is growing, but stocks in the country are high given the increased security at the Chinese border. Indonesia is still dominated by raws flows, with whites purchases being opportunistic. The Philippines is a small but important importer.

East Asia therefore looks like a tough area to compete for white sugar sales. Small things can make a big difference to how your sugar is perceived. For example, are you making sustainable sugar? It’s an excellent way to differentiate your products. If you’re unsure about how we can help you through Vive, please click here.

The final area of demand for East Asia is, funnily enough, Africa. Asian suppliers here compete against locally produced sugar and Middle Eastern refiners. Price means everything. Stocks are high, but lower prices can lead to traders averaging lower.

Thai whites in 2019

So where does this leave Thai whites availability? We are assuming that Thailand has around 750k tonnes excess refined sugar to sell this year, which is higher than last year’s whites surplus. We are assuming it will be carried into 2020 at which point it will be sold domestically or exported. Effectively, if we look back at the Trade Flow chart, Thai whites are the whites surplus in Q4’19.

Global Sugar Trade Flows

One way the market can try to resolve this oversupply is to give a signal to toll refiners to make less refined sugar in response to the Thai oversupply. This will start to push the whites surplus back into the raws. This means I think the white premiums should start to weaken again to undermine the toll-refiner business model, which means a price in the low $60s or lower.

To summarise, we’ve spoken about how the market is oversupplied. I think raw sugar prices might re-visit 10c and that the raw sugar spreads should remain weak. It’s going to be difficult to exceed 14c at today’s energy prices and FX. I think the white premium will probably stay in a $50 to $70 range, but perhaps mid-range to discourage toll refiners from increasing melt rates. As we move into 2020 it looks like this situation will persist unless weather is poor in India or the EU. In this environment, how can you extract maximum value from your businesses?

Managing white premium risk

Czarnikow is a services and technology company. We exist to serve you; to help you run your businesses as well as you can, and we aim to do this using the very best technology. For many people in the company that has meant that we’ve had to change how we work radically in recent months.

When I first joined Czarnikow all of our data was held in Excel. We now have data held in proper databases, which means we can share data directly with our customers in real time through our new platform. It also allows us to do far more powerful analysis of the data. For example we can help people manage their market risk through a white premium Risk Advisory service, which is a tool we use to create a set of guidelines for pricing decisions. This will ultimately be embedded into our new client portal, Czapp. We already offer a similar product to allow Brazilian sugar mills to manage their No.11 futures market risk. Brazilian mills using this hedged their raw sugar on average at 13.50c last season, compared to an industry average of below 12c. If you are interested in seeing whether this tool can help you to make better decisions in the market, please contact us at hannah@czapp.com.

Czapp

All of our analysis – this speech, our Risk Advisory service, everything – starts with Czanikow’s global network. This network is dedicated to finding out what’s going on in the global sugar trade so that we can bring you the conclusions without you needing to do any work yourself. We deliver these conclusions to you through our new platform, Czapp. It’s web-based at the moment but the mobile app will launch in the coming weeks. Everyone can sign up – simply go to www.czapp.com and register.

In time we intend to provide to you a complete range of Czarnikow’s services through the app. To begin with, we’ve launched the app with our analysis, and we’re putting you in control. You can read it online, or download it as a PDF for later. You can indicate which analysis you like so that we know to keep covering that subject. If you want to make your own conclusions you can now also access exactly the same data that our analysts use.

Now that Czapp has launched we are improving it every single day. We already have a huge list of suggested changes from my colleagues at Czarnikow. We would love it if you could also give us ideas about how we can make it better for you.

And with that, I’ve finished. I’d like to thank you again for coming to see us today.

Author: Stephen Geldart, Analysis Manager