Regular readers of the blog will know that we’ve written a lot on specific commodities, trading strategies and price relationships, but we had not done a post on the basics of commodity trading – until now.

Commodity trading meaning

In short: commodity trading is the buying and selling of raw materials, which means it is the foundation of the primary global economy. Generally, commodity trading can be split into physical (moving materials from point A to B) and financial trading (exchanging commodities commodities). As you read on, you’ll find that there are many moving parts to physical trades, financing structures and developing a trading strategy e.g. price risk management .

Types of commodities

Broadly, there are three categories of commodity: energy, metals and agricultural. At Czarnikow we trade agricultural commodities like sugar, fruit, and dairy, but also renewable energy. Given that energy sources like crude oil, and metals like steel power the cargo ships that transport agricultural goods around the globe, the three markets are linked.

What is physical commodity trading?

Simply put: physical trading of commodities is getting them from one place to another. However, moving millions of tonnes of materials across seas (because nearly all commodities are transported by maritime vessels) is, unsurprisingly, not simple in practice. Since commodities are natural resources, and numerous in some parts of the world whilst scarce in others, they are often more valuable to the economies of their origin countries when traded internationally than just domestically.

Yet complex international relationships can pose challenges for efficient cross-border trade. It is not as common now but before the World Trade Organisation (WTO) was created, tensions between nations could lead to goods being rejected at port destinations, heavily tariffed or denied to some countries, the 1973-74 crude oil crisis is a well-known example of the latter. Trade policy can reflect foreign policy. Today transportation shortages and fluctuating interest rates still pose problems at ports but the WTO’s jurisdiction over 98% of global markets has made physical trading more efficient.

Who trades commodities?

There are those who have to: producers of commodities who need to sell their goods to consumers (sometimes manufacturers) in exchange for currency, and those who choose to trade commodities. Commodity markets got more interesting when individuals with a knack for finance got involved and developed new trading strategies. One key example is the advent of futures contracts which gave buyers and sellers more flexibility by allowing them to fix their prices into the future, hence the name. This protects them from fluctuations in price and whil allowing them to budget in the long term, reducing exposure to factors that can disrupt the trade flows, for example weather or international conflicts. We can look to the Chicago Board of Trading (CBOT) as the facilitators of the first successful standardised trades of agricultural commodities in the USA.

How are commodities priced, anyway?

While producers and consumers trade goods and hedge their exposure, speculators trade just to make a profit. Speculators (also known as ‘specs’) take a long or short position on a derivative or stock if they expect the value of a commodity to rise or fall, respectively. This means that specs add liquidity to and can influence how a market moves without owning the commodity that is traded. But sometimes governments can set the price, this is quite popular in agricultural markets to protect farmers’ returns.

Things to know before you start trading any commodity:

- Where the commodity is produced;

- What moves the price. The answer is almost always climate, geopolitics, currency strength, freight rates and global health and climate – especially for agricultural commodities;

- How volatile the market is;

- The most common trading methods and strategy for your commodity of interest.

By land, air or sea?

Freight forwarding is the service of moving cargo between stages in the supply chain. Most of the time commodities are transported by maritime (or sea) freight, mainly because it is much cheaper than air freight. We can split sea freight into two categories: bulk and containerised. Unpackaged (they can also be packaged sometimes – known as breakbulk) raw materials are transported in bulk ships that is loaded directly into the vessel, whereas container ships move goods stored in intermodal containers. You may just be learning what they are called but chances are you’ve seen images of the large, metal, rectangular boxes that have become almost synonymous with freight.

Before they reach ports, commodities rely on land freight like trucks and trains, to get around. Trucks, while an essential link in the logistics chain, are typically outshone by ships. But with the overwhelmed trucking industry in 2020-21 leading to delays at ports, it is gaining more recognition (and appreciation, hopefully). Still trucks are more popular than rail freight, their more energy efficient counterpart, because of lower handling and fuel costs.

The priciest and fastest choice is air freight because planes are costly to maintain. Unlike the cost of sea freight, which is based on volume, air freight costs are based on weather conditions.

How freight rates affect commodity prices

2021 has been one of those rare years when the cost of seaborne freight has surpassed the cost of the commodity being shipped in some cases. Government stimuli to ease the fallout of the 2020 coronavirus crisis have increased demand for dry goods like iron ore, coal, grains and sugar which are shipped on bulk vessels; in doing so competition for bulk and container vessels has soared, sharply driving up the cost of freight with seaborne trade volumes off the scale.

It is taken for granted that higher demand for commodities will increase demand for transportation consequently making the commodities and freight rates more expensive. While freight demand is increasing, supply is limited as vessel manufacturers are swamped with orders – more than they can produce currently; 80% more vessels were produced in the second half of 2020 than 2019. Higher returns on products can incentivise producers to increase their output which means the positive feedback loop is maintained. This year, more grain exports from major exporters like the USA have called for an extra 227 Panamax shipping vessels – learn about the different types of maritime vessels here. Since the freight cost contributes to the total cost of the commodity, they are passed onto the end consumer.

Changes in goods consumption have and will continue to dictate the frequency of trade flows and profitability of commodities. In the last two years demand for cocoa declined considerably following the introduction of social restrictions to reduce the spread of COVID-19 which hit the catering industry in many countries such as China and the UK.

Know the language of the trade: incoterms

Incoterms, a portmanteau of ‘International Commercial Terms’, are used in describing the responsibilities of buyers and sellers of goods, or the rules of a transaction. They can outline who needs to handle the shipment of a product, documentation, insurance and so on – incoterms in 2022 are the same as the most recent update in 2020, and prior to this they were previously updated in 2010. As the name suggests, the terms are recognised internationally and finalised by the International Chamber of Commerce. One term that you will see a lot is ‘FOB’ which stands for ‘Free on Board’, it means that the seller must deliver the goods to the buyer on board a vessel nominated by the buyer at a port which has been named as the place of shipment.

What makes a good physicals trader?

The primary role of a trader is price risk management. The point of physicals trading will always be to move goods around, but goods are bought in advance and the market moves quickly so it is crucial that you hedge your exposure to price changes. Again, we’ve got an entire post dedicated to this topic.

Market position keeping

A good trader is always up to date with the status of their trade so they know how much of an asset needs to be bought or sold depending on if they hold a long or short position – and you should be too. Naturally, other trades and world market fluctuations will affect your trade which is why you need to mark-to-market. ‘Mark-to-market’ means valuing the asset you are trading against its market value at a certain time; this returns the value of your market position therefore if you’ve made a profit or loss. When you’ve got many positions open and are trading in futures and physicals, this gets taxing especially when you are new to the market, that is why Czarnikow offers this service.

Financial commodity trading explained

One way to manage risk is with financial trading. Commodities can be traded on financial markets in the form of contracts called derivatives. Derivatives allow you to secure the price of a commodity that you will need in the future; you can think of them as the tools that bring physical and financial trading together.

Commodity futures trading

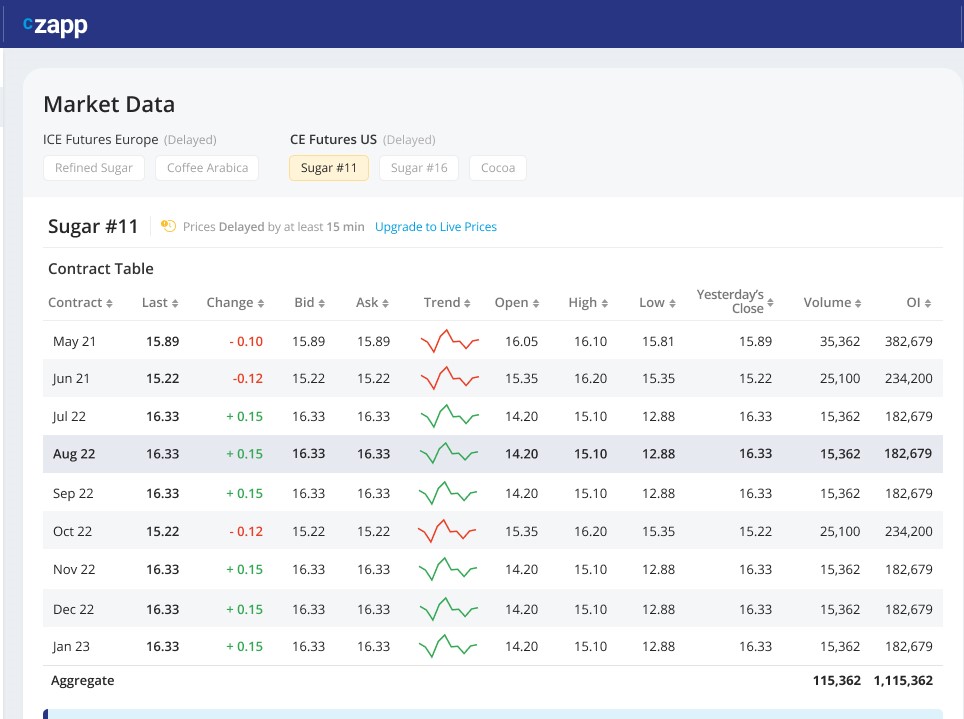

Futures set the price of a commodity at a specific location and time in the future, acting as a benchmark for the price of a commodity; this means you secure affordable price and ensure delivery for a date in the future.

Although they are just one type of derivative, futures quickly dominated the financial side of the commodity trade because they solved many of the issues producers and consumers had, while opening the door to traders outside various commodity industries. Find out how Czarnikow uses futures here.

How the financial market affects the physicals

Besides futures contracts, options also exist on most commodities. Options are derivatives. An options contract gives the owner of the contract the right but not the obligation to buy or sell a contract or a commodity. These can be further used to manage price risk by commodity producers and consumers.

With all of these derivative contracts, the majority are closed out before contract expiry, when the underlying physical commodity needs to change hands through a delivery via the exchange. This is because most physical commodity trades do not take place via an exchange, they are bilateral. At the time the physical trade has happened the derivative hedge can be lifted.

How the futures exchange fits into physical trading

The exchange enforces rules surrounding futures and options contracts. If these contracts are held to expiry, they are settled either by physical delivery of the underlying commodity or by cash transfer between traders. The futures contracts specify exact terms for the physical commodity, including delivery date, quality, location and incoterms. The exchange is the counterparty for each, so minimizing counterparty risk. Traders opening positions must put up a deposit, or margin, for the duration of the trade.

The Commodity Futures Trading Commission (CFTC) gives regular updates on the number of positions open in the market, in other words the volume of contracts being bought and sold, in their Commitment of Traders (COT) report. Commercials and specs use this to gauge the market structure and predict pricing behaviour.

Looking To Buy Sell Or Move Sugar?

Investing in commodities with exchange traded funds

The Exchange also houses exchange traded funds (ETF): investment funds that can contain stocks, bonds, currencies, and commodities. They are similar to stocks but less risky and tend to be used by large funds. A commodity ETF can hold several physical commodities, usually in the form of futures, as well as stocks.

How commodity swaps work

As futures were taking off in the 1970s, traders got more creative with their derivatives, ushering swaps and forward contracts into various commodity markets. Since a swap is a derivative, it gets value from an underlying, but it differs from a futures because the two parties always agree to exchange cash at a future date meaning there is never a physical delivery of the underlying asset. How much cash is exchanged? The difference between a market price and fixed price (as stated in the contract).

A swap is an example of we call an ‘over-the-counter (OTC)’ derivative because it is not traded on an exchange. The low volume of OTC compared to exchange traded contracts means that the OTC network is less liquid.

When the freight market meets derivatives trading

While swaps were gaining traction in the 1970s, forwards (another derivative) took off in the freight market just a decade later. If a futures is an off-the-rack blazer, a forward is a bespoke suit jacket i.e., tailored for you. The forward freight agreement (FFA) is a contract used by vessel owners to protect against price movements, so the underlying is the freight rate. An FFA is an OTC in which the ship owner takes a long position and the charter takes a short. FFA volumes are growing rapidly in 2021’s hyperactive freight market and trading at higher prices.

There you have it – a guide to the business. We covered a lot in this guide and you might find yourself wanting to know about some of the topics, so check out these blogs on:

- Derivatives and physical ethanol trading

- Price Risk Management : How We Use Derivatives

- The Freight Series: Bulk shipping

- An interesting financial strategy: Buy High, Sell Low (czarnikow.com)

- Commodity Trading terms

You can submit all your business queries in our contact form. And don’t forget to share this blog on Facebook, Twitter and LinkedIn.

FAQs about Commodity Trading

Stock trading is all about financial tools, but commodities trading is about facilitating supply of raw materials that can be used for financial instruments. It is often thought that specs, investors and arbitrageurs are the main participants in both markets, but consumer and producer activity tend to dominate in the latter.

Trading platforms can include an exchange, that is an organised marketplace for financial instruments including stocks, shares, commodities and derivatives. Sometimes, this term is used interchangeably with ‘the market.’ Examples include the NYMEX and ICE. Alternatively, you can trade ‘over the counter’ (OTC) which is the term for a bilateral trade between counterparties that is not facilitated by an exchange, with it comes more flexibility and risk.

Bids and offers for a futures contract affect its price. The volume of spec long and short will affect the buying and selling price respectively. Meanwhile commercial longs and shorts – those held by producers and consumers – represent the amount of buying or selling that has been hedged.

A commodity trading house is company that buys and sells futures or physicals on the behalf of clients. For example, Czarnikow is a soft commodities and energy trading house.

The CFTC is the Commodity Futures Trading Commission, the regulatory body for futures markets and is a US federal agency. On Mondays we share a CFTC update featuring net spec and commercial positions for the Sugar No.5 and No.11 on Czapp. You can also use our positioning data dashboards for soybeans, corn, cotton, wheat, sugar, cocoa to find the data you need.