For many people, the phrase ‘buy high, sell low’ may seem surprising. It appears to go against most well-known financial advice when it comes to markets and trading, as well as one’s natural instinct. However, it is extremely important to know that commodity transactions are not always as simple as buying low and selling high. What many people don’t know is that there are multiple strategies in which you can indeed buy high, sell low and still make a profit. The way in which all of this is made possible is through hedging market exposure by buying and selling futures contracts on an exchange.

The Futures Market and The Exchange

An exchange is an organised market where tradeable securities, commodities, forex, futures and options are bought and sold. Historically, the exchange can be dated back to 13th century Belgium and the ‘Ter Buerse’ inn. The Ter Buerse building developed into the leading commercial and financial centre of Belgium where brokers would assemble and correspond about local economies and the state of the foreign markets. It eventually began to announce exchange rates of the leading commercial centres of Europe and an organised money market developed solely for trading commodities. Similar exchanges began to appear across the world with the first modern organised futures exchange being established in Japan in 1710. Undoubtedly, the Ter Buerse in Bruges was fundamental in the development of the stock market and trading as we know it today. Czarnikow itself was also a founder of the first ingredients and agricultural goods futures market established in London in 1888 called the ‘London Produce Clearing House’.

As explained in our previous article, futures are contract agreements between two parties for the purchase and delivery of an underlying asset, for example sugar. They are a type of derivative and can be used to benefit both the buyer and the seller of a commodity. To find out more about how the concept works you can watch our jargon-free guide to derivatives trading:

Futures contracts are standardised because they are traded on an organised exchange, as explained above. However, it’s important to remember that the futures market differs from the physical market in a number of ways. Through the physical market, sugar is bought and sold at an agreed price, with an agreed date of delivery whereby the seller will make the physical sugar available at an agreed delivery point and the buyer will receive it accordingly. However, the futures market facilitates buyers and sellers to trade specific quantities of sugar at a price independent to each party, specified by the exchange (for the contract months of March, May, August, October and December in the case of refined sugar) up to 18 months in the future, whereby physical delivery of the sugar does not necessarily have to take place.

Essentially, trading on the futures market can be simply a financial exchange without the involvement of a physical commodity. Indeed, if a buyer or seller on the futures market does not intend to go forward with a physical trade of a commodity, they are permitted to buy back the specific quantity of futures which they sold to the exchange or equally to sell back the futures which they bought from the exchange before the expiry of the corresponding delivery month, but at the prevailing market price. This is a crucial aspect of the futures market and its advantages will be further explained below. As far as sugar goes, there are two futures markets: No.11 for raw sugar traded in New York and the White Sugar Futures contract for refined sugar traded in London. With a brief outline of the differences between physicals and futures, what now comes into question is the purpose of the futures market: what is the benefit of trading futures contracts on commodities such as sugar if a physical exchange never takes place and how does it bring value to the participant?

Futures contracts are beneficial for what is called ‘hedging’ risks. The ultimate goal of most participants using the futures market to hedge, such as producers, processors and end users, is to offset any financial risk for their business caused by exposure to the volatility of the underlying commodity’s price. It should be noted that there are also speculators who take more risk and purely speculate on the volatility of the futures market price. In order to most effectively demonstrate the financial benefits of hedging on the futures market, it is best to use specific examples. We will usevarious examples below, specifically focusing on the White Sugar Futures market for refined sugar traded in London. The White Sugar Futures contract is traded in lots of 50 tonnes and has standard contract terms such as being traded in US dollars per tonne, packaged in 50kg bags and being of quality EEC-2.

The Perfect Hedge

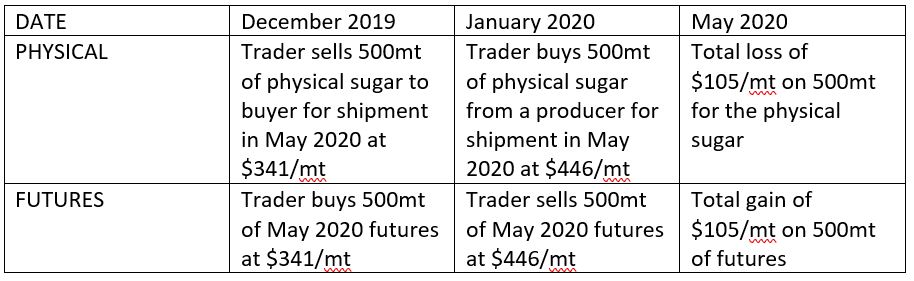

Below is a table to show how a broker or a trader, like Czarnikow, would make a physical contract and simultaneously hedge the corresponding amount on the futures market in order to offset risk.

Here the table clearly shows how, without hedging on the futures market, the trader would have simply been at a loss of $105/mt at the end of the physical contract. The futures market however, allowed the trader to offset risk and simultaneously generate a positive of $105/MT on closing out their futures position, thus balancing out the equal and opposite loss on the physical and resulting in the perfect hedge!

Buying High, Selling Low

As the futures exchange is a centralised clearing house, it acts as a counterparty for every trade that takes place, thus reducing risks on defaults for both buyers and sellers. Clearly demonstrated by the perfect hedge example, it is possible for traders, buyers and sellers to buy high and indeed sell low without being at a financial loss. Therefore, whilst the phrase ‘buy high, sell low’ is a provocative statement being contra to natural economic logic, it can be seen that multiple commodities markets are able to facilitate the trade of physical sugar in all market conditions. In addition, when using differentials, traders and brokers can in fact not only mitigate financial losses but make financial gains.

Differentials

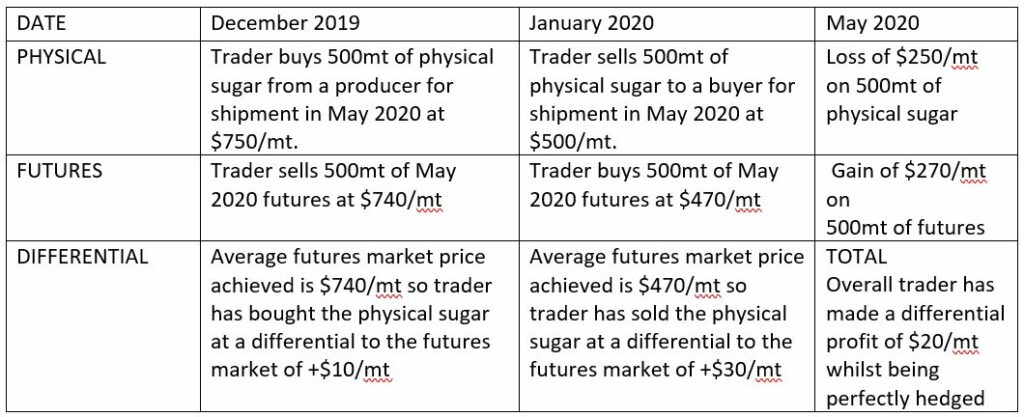

Differentials to the futures markets also play a major role in establishing the price and thus the fair value of specific physical sugar being negotiated for contract. Differentials are simply either the premiums or discounts to the futures market prices and are determined by a range of criteria such as: availability/scarcity, geographical location, quality, shipment period, packing and incoterm (e.g. FOB – Free On Board, CFR – Cost and Freight). Below is an example of how a trader executes a perfect hedge whilst incorporating physical differential trading:

This example shows how the trader has hedged out (and therefore neutralised) the world market price risk and has only taken the differential risk. In this transaction everybody should be satisfied; the trader facilitating this structure has succeeded in their endeavours as the producer has sold at a high price and the buyer has bought at a low price. As for the trader themselves, they have indeed ‘bought high and sold low’ but only traded the physical sugar differential risk to the world market futures price, and not the actual futures price risk itself. They have also made a differential benefit of $20/mt. The crucial notion to take into account following this example is how it is possible for the trader to advise both the producer and consumer on price without a conflict of interest as well as ensuring a fair value margin for themselves. It also allows the Trader and their clients to take advantage of differing global crop cycles, buying and selling sugar at the most efficient points in the year, when the physical differential is most favourable, whilst mitigating any futures market risk.

As you can see, contrary to instinct it is possible to buy high, sell low and still make a profit. Our derivatives and trading teams are constantly working to use the futures market to its full potential amidst market volatility. To find out more about how we can help, get in touch today.

Author: Betty Rook